Inflation: Everything You Need To Know

Matthew Cheema

Has the dramatic rise in gas prices the past 6 months left you dazed and confused? What about the produce and dairy at your favorite supermarket? Do we even dare to mention the staggering real estate prices throughout the country?

There’s a new buzzword in town, and if you’re reading this article, chances are you’re trying to make sense of what it means and why it’s happening. Inflation has become a hot topic at every dinner table conversation and it appears that almost everyone has their 2 cents to chip in.

Today we’re going on a journey together to understand what is happening in the world right now, how we got to this point, and most importantly; what you can do about it.

What is Inflation?

According to the Oxford dictionary, inflation is defined as “a general increase in prices and fall in the purchasing value of money.” In other words, the same dollar today will buy you less than it did in the past, because the cost of goods and services continue to rise over time. This holds true in virtually all areas of life, including; real estate, gas, cars, phones, groceries, flights, utilities, materials, you name it.

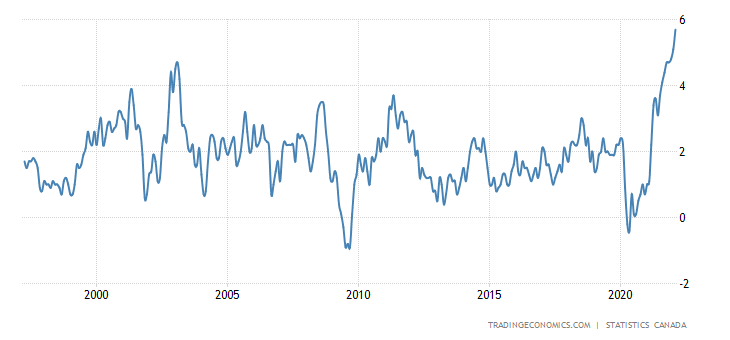

In the past 20 years, you can see how inflation has hovered between 1-4%. This means that every year, the prices of goods and services are increasing on an average between 1-4% in Canada. This is a cumulative average of all industries across the board, meaning certain sectors can be rising substantially higher than these numbers, while others are rising lower than these averages.

We’re going to take a look shortly at which sectors have been inflating the highest and which ones are affecting the daily lives of Canadians the most.

How did inflation start?

There was an event that took place in our history which became the great catalyst for the commencement of the inflationary currency system we use today. Before 1931, the monetary system in which most countries in the world had adopted was the gold standard system. Each country’s currency or paper money was directly attached to gold, and the price of gold was determined by the country in which they would use to buy and sell goods. Since the currencies were directly pegged to the value of gold, the currency or paper money could be traded in for the gold itself.

The reason why currency was created in the first place was to make trading for goods and services easier (imagine carrying gold with you everywhere to purchase things). And since the currency was pegged directly to gold and that gold is a scarce resource, theoretically that system would be deflationary (the opposite of inflationary), and the currency being used to trade would become more valuable over time. This would prevent human manipulation, over lending and corruption from banks, excessive printing from governments, and promote an economically flourishing society for all its participants.

The event that changed all of that was in 1933 when US President Richard Nixon decided they were going to abandon the gold standard system (The UK had also done this in 1931) and replace it with the current system of today, the fiat system. This new system of money would no longer be pegged to a commodity which gave governments and banks a lot more freedom to manipulate the money supply through doing things such as excess printing (before you couldn’t print money unless you had gold to peg it to) and overissuing (banks are able to lend out the same dollar to multiple borrowers). These happenings over time are what have contributed to an inflationary monetary system that we have today.

So, if inflation has been around all this time, why is it such a buzzword today?

Simply put, people like to talk about things that are directly affecting them and their lives. In normal years, maybe the rising cost of goods and services are slightly noticeable, but not enough for most people to say or do anything about it. But today we are seeing hard working people being hit harder in their wallets than ever before, and it’s causing tremendous amounts of pressure and stress among the working class of Canada.

These numbers are no joke and no one seems to be laughing either. From 2020 until now, the Canadian and US governments have printed over 1/5th of the total amount of money that has ever been printed in the history of their monetary systems. More money was printed in the past 2 years than the past 100. Let that sink in for a minute. And if we’re thinking in basic terms of supply and demand, what do you think will happen to the value of the dollar when all of a sudden there is more supply than it’s ever had in its history? It’s going to go down. And what does it mean when it’s going down? Inflation. In fact, more like hyperinflation.

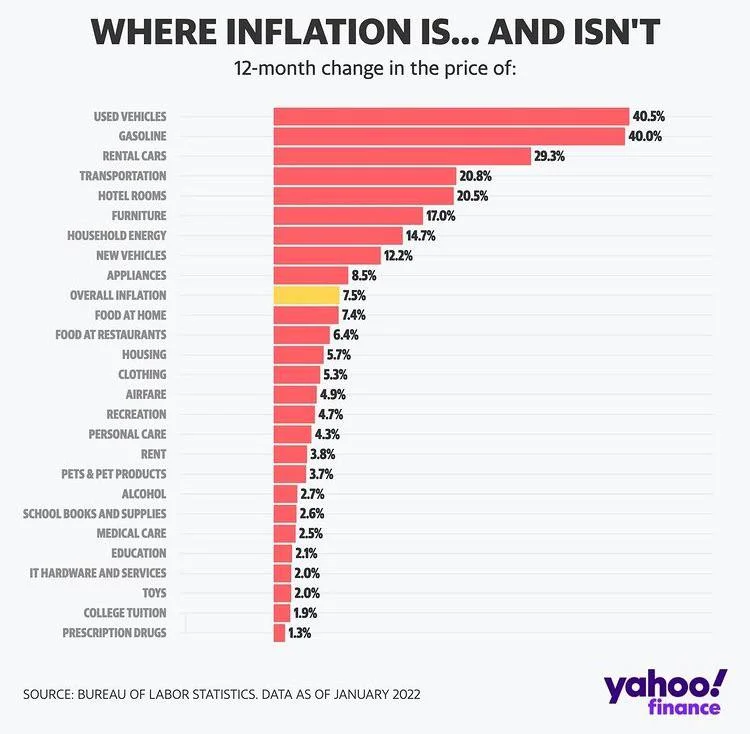

That means you have to pay 40% more on your gas bill for the same amount of gas. 7.4% more for the same food and groceries. 20+% more for the same amount of transportation. The list goes on and on. We are now experiencing the ripple effect of actions that were taken and unfortunately many experts are saying that we are nowhere near the end of it either. So brace yourself friend, and be prepared to take action with the guidance we provide so you can win this battle against inflation and come out the other side better off than what you were before.

Inflation vs Your Wages:

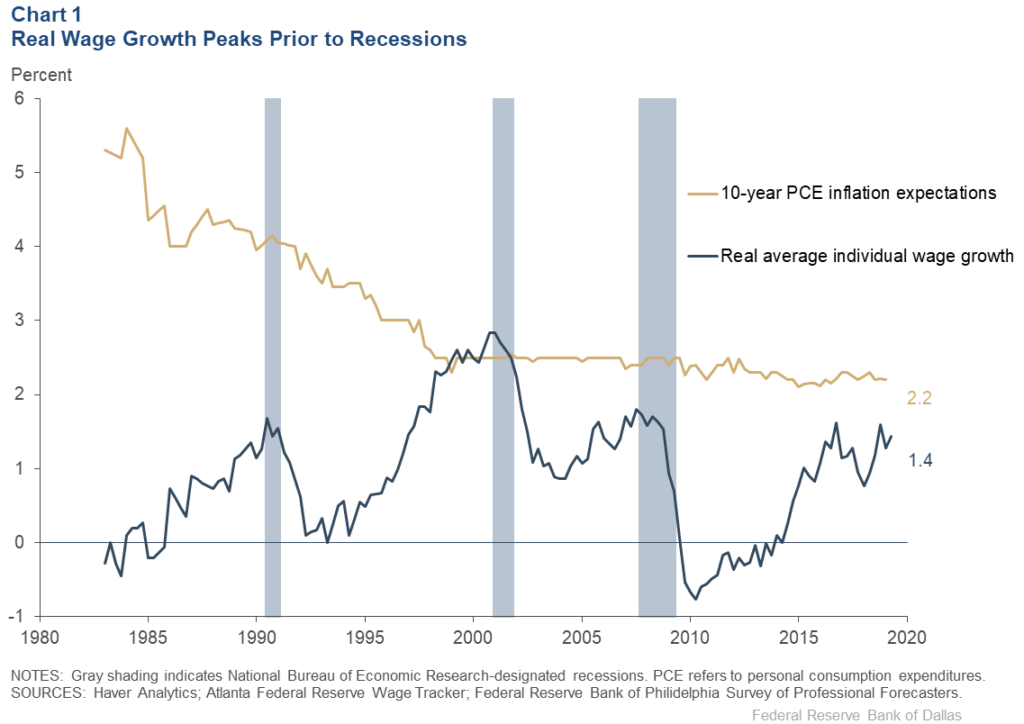

The reason why inflation hurts us is not just because of the rise of goods, it’s the lack of rising wages. If your wages had gone up 40% in the past year, would the new gas prices sting as much? Or the grocery bill? Or the price of the home you want to move into? The major problem is that almost every year for the past 50+ years inflation has been rising faster than the wage growth. That means life for middle class Canadians is becoming more and more challenging as time goes by. People are forced to move further and further away from the big cities, the average first time home buyer is now 36 years old, and being paycheck to paycheck is a societal norm.

This graph shows the increase of inflation vs wage growth since 1980. You can see for almost every year that inflation has been consistently rising higher than the wage growth. The numbers of 2021-2022 are not reflected in this chart, but if you could guess, what do you think the chart would look like if we factored those years in?

Not only is the wage scenario bad (and getting way worse), but on top of your salary not keeping up with inflation, chances are the leftover money you have at the end of the month to save isn’t either. As shown on TD Bank’s website, the average interest rate on an everyday savings account is 0.01% APY, with their highest APY being 0.5% in their epremium savings account if you hold more than $10,000+ in the account.

Let’s do some basic math together so we can understand what this means…

Say I have $20,000 sitting in my TD bank epremium savings account earning me a handsome 0.5% annual interest. That means after 1 year sitting in there, my money would be worth $20,100. ($20,000 + 0.5%). So I earned $100 by doing nothing but letting my money sit inside of the account, could be worse right? Well, actually, it is…

While our $20,000 just earned us 0.5%, did we not remember about the current 7.5% (and rising) inflation that we’ve had in the past year?

Here is what the real formula looks like:

$20,000 + 0.5% – previous year’s inflation rate (7.5%)

= $18,600

While these are not the numbers reflected inside of your bank account, this is the reality of how much your $20,000 is now worth in terms of purchasing power. Your $20,000 can now purchase you $18,600 worth of items that one year ago you were able to get the full $20,000 worth. That 0.5% epremium savings account actually cost you $1400 in purchasing power, an average of $115 per month just vanishing into thin air. And chances are if a lot of your purchases are going to gas, food, and other things above that 7.5% inflation average, it could be even worse for you.

What can I do about all this?

Okay, so my wages have not been increasing faster than inflation, and my neither have my savings, so it sounds like I’m headed towards an inevitable financial doomsday where I will no longer be able to afford to live based on the money I am making and the cost of living, is there any chance for me?

First of all, we hear you. The reality is you are not the only one who is facing this painful truth. Unfortunately the majority of Canadians are in the same situations, whether they have realized it yet or not. It isn’t your fault either, the way the school system and financial system are designed are not to teach people how to get ahead or become wealthy. They are designed to keep people in the middle, in dependence, and be stuck working nearly until they are physically unable to anymore.

The good news is that it doesn’t have to be this way. Whether you are a doctor, a construction worker, a school teacher, a single mom, or a postal worker, you can in fact live a life of financial freedom and abundance. Not just to win this battle against inflation, but to live the life you deserve. The one you’ve always dreamed about. That is possible for you no matter your profession. All it takes is the right awareness, strategy, and action, and today we have 5 points to help get you started along that path.

1. The Decision

For anything to change in our lives, we must first change. It is our act of changing and evolving that will lead to the changes we see in our physical environments. Whether that is making changes to our diet and exercise and later seeing physical changes in our bodies, to practicing a new language over and over until we can converse with someone in real life. The same goes for your finances. If you want to take control of your finances and use money to create the life of your dreams, you need to start making the right choices and changes. And those will come after making your decision. You need to decide that you’re going to do this. You need to decide that you’re going to take control. That you’re going to learn the money game. That you’re no longer going to be a victim to the outside world but to change it from the inside. I encourage you to build up enough energy within yourself to make a decision so strong that there is no going back. Decide that you’re going to be the creator of your life and take control of your financial destiny. From there, everything else is possible.

2. Find ways to increse your income

If inflation last year was 7.5%, what can you do this year to increase your income by 8% 10% 50% 100%? Have you ever thought about how different your life would be if you could double your income this year? What would it take? What would you have to do? How can you add more value to your current employer for them to see that they need to pay you more? Notice I said how can you add value before receiving the pay? Most people will never do that because they have an entitled mentality and think that they should be paid first before they perform better. Life doesn’t work like that unfortunately. In a capitalistic society people get paid based on the value they bring to the marketplace. So what are some ways you can bring more value to your company which will lead to you receiving greater compensation down the road?

If you’re a business owner or self-employed, how can you increase your revenue this year by 20%, 30%, 50%, 100%? How many more clients would you need to help? How can you attract that many more clients? What would it take to scale to those numbers? How can you separate yourself in your industry by adding more value to your service/product?

Once you have taken action to increase your value and income in your first flow of income, are you going to think about adding a second flow? A side hustle? A part-time business? A new project? A new real estate investment? How can you increase your first flow by over 10% and then also start a new flow of income? What skills do you have that you could be compensated for? What special talent do you have that you could monetize? All of these questions will start racing in your head once you make a firm enough decision that you are going to free yourself financially.

This may sound overwhelming or a big grind, but there’s no sugar coating what it’s going to take to free yourself from an inevitable financial devastation that is on the horizon for millions of other people out there. And if you think about it, would you rather put in some extra hours now and free yourself for the rest of your life, or continue working until 65 years old and never have enough money to comfortably retire?

3. Invest into assets to outpace inflation

One of the biggest separators between the wealthy and everyone else is that the wealthy know how to put their money to work for them. We have all been taught how to work hard for our money, but only a few people have been taught how to make their money hard for them. The wealthy people know this. And if you talk to any of them, you’ll probably come to learn that they all have their own strategies that work for them. Some are hardcore real estate people and real estate is the only thing they do. Some invest into the stock market, some buy businesses, some invest into cryptocurrency, there’s many different ways to do it.

One of the most simple and passive ways of investing but still earning a rate of return higher than inflation is by investing into mutual funds and index funds. This puts the decisions making out of the hands of you and over to the portfolio or fund manager, who is paid to ensure that the funds you are investing into are performing at a competitive rate.

Whatever the strategy is, they are all doing the same thing for the most part, which is: investing into assets that appreciate in value and outpace inflation. If you find an area of investing (or multiple) and can achieve this result consistently over time, you will find yourself in a position one day where you will no longer have to work to pay your bills anymore because your investments are earning you enough money to support your desired lifestyle (financial independence). This does not happen overnight, but over time it can provide a very abundant lifestyle for you and your family.

4. Cut down spending

This area should take less than 20% of your time and energy, however it is extremely vital and should not be overlooked. Many people have absolutely no clue where their money goes every month. They are so used to receiving a paycheck and using it until there isn’t any left and then waiting for the next one to come in and do the same thing. If you were to implement a budget tracker on your phone or computer and once a week sit down for 15 minutes to do a weekly review of your spending, you would probably notice after a month that there are so many unnecessary expenses in your life that you really don’t need. This could free up at least a few hundred dollars each month for which you can use to invest and free yourself in the future.

Check out this website here to find a template that works for you.

It’s also a respect thing. If you want money to be around more in your life, it needs to feel respected by you. If you don’t respect someone, they don’t like to be around you that much. They will be there for whatever they need to do, but that’s about it. Same goes with money. If you are careless with it, spending it unknowingly, not treating it well, you will also notice that it does not want to have a big role in your life. But if you start to treat it well, consciously spend and use it, use it for things that are beneficial to you and it (growing it) then you will start to see that more money will start entering your life as a result.

Now, when it comes to expenses, you have to have a real conversation with yourself and evaluate what’s important to your life. What expenses need to stay, and which ones can you afford to live without? Can you live without starbucks every morning for the next few years and make your coffee at home? Or one less fancy dinner each month? Or a few less online subscriptions? It’s time to cut the fat, and remove unnecessary expenses from your life that are interfering with your wealth. Your goal at the very minimum should be to save 20% of your net yearly income. If you can eventually move that to 40%, you will be very well off. But 20% will still lead you to a very financially abundant life if you not only save it, but invest it. If you’re only saving to save, you won’t get anywhere near your full potential if you had taken the time to learn to invest.

5.Plan for the future

If you hopped in the car and were told to drive to a location that you had never been to before, how would you get there? You would likely take a few minutes before starting the car to input the location into your google or apple maps and then find the quickest route on how to get there. Doing that gets you to your destination the fastest, most efficient, and with the least amount of used resources. Imagine you had tried getting to an unknown location with no route in your maps and just by going off of a hunch. Maybe you would get there, but likely in way more time and resources spent.

Do you see where I’m going with this? If your destination is financial freedom, what’s your route? How do you plan on getting there? How will you increase your income? Where will you invest your money? How much do you need coming in every month to support your desired lifestyle? What investments can take you there and in what amount of time?

To the degree that you take the time to learn, plan, strategize, and finally take action, is the degree in which you will achieve your goals. Many people’s financial plans are just mere pipe dreams with a splash of hope. There’s no clarity, there’s no route. You can get to whatever destination you want, there will always be a route. You just need to take the time to figure out what it is.

For many people getting started in their journey of taking control of their finances, it’s overwhelming and they don’t know where to start. The financial world is huge and intimidating, and if you don’t have sound knowledge or clarity, can also be very costly.

Our focus as a company is elite level wealth strategy and management. We specialize in teaching everyday people the concepts which the wealthy people use and apply to create lasting generational wealth for their families in a way that’s simple, digestible, and applicable. Our team are licensed professionals and highly trained in strategic planning. This is different from an average bank where you get set up on high interest savings accounts yielding you 0.5% interest. Here you get personalized 1-1 consulting, customized financial plans and strategies, and access to a community of like-minded people who are all on their journey to creating wealth and financial freedom. If you are ready to get started on your journey today, you can book a free consultation with a wealth strategist and they will help you get started on mapping out the route to your destination.

Conclusion

If you have made it to the end of this article, congratulations. We covered a lot of ground and it was probably a bit of a roller coaster at times. By now you should have a greater level of understanding of the current world conditions, the role inflation plays in our lives, what will happen if we don’t do anything about it, and what can happen if we do do something about it. I want you to know that no matter your situation or career path, you can utilize the strategies and concepts we talked about today and create a brighter future for yourself. The biggest thing it comes down to is action.

Nobody became wealthy by thinking about it. They became wealthy by doing something about it. It’s time to start doing. To make new choices. And to Empower your personal economy. Nobody can do it for you except you. Consequences will happen whether you take action or not, the good thing is you have control over what kind of consequences you want to experience.

If you want to gain some clarity on where to start, what strategies are right for you in your current situation, and a detailed map to your financial freedom timeline, you can book a consultation with one of our Wealth Strategists here. They are professionally licensed and contracted with the top Banks, investment companies, and insurance companies in the country. Our mission is to help everyday people by giving them access to the strategies and resources that have been reserved only for the wealthy until this point. We want to make becoming wealthy mainstream, and create a wave of financial abundance for this new generation.